What good is money to you? Is it stuff? Is it status or power? Nothing is wrong with these. However, I find that when most people say they want more money, they really want options.

But what if you could have options now?

Finances, salary, compensation, and the value of being cheap

What good is money to you? Is it stuff? Is it status or power? Nothing is wrong with these. However, I find that when most people say they want more money, they really want options.

But what if you could have options now?

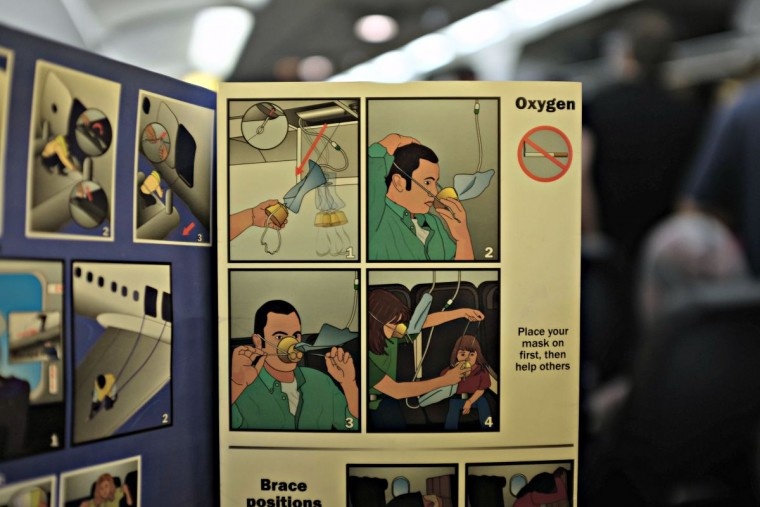

Some of us have a serious problem not helping others. We give time, resources, and money until we are overbooked, drained, and broke. We give until we are bitter, empty, and exhausted. And sometimes, we are sad we couldn’t help more! This is a problem.

You enjoy helping people. I have the same disease. Why say no when it’s only a little inconvenient? Why charge money when you can give it away? Why not go the extra mile, and the next?

Because it’s selfish.

I recently switched cell phone carriers. Though I never had any significant problems with the old carrier, it never rang the excellence bell. That, and my favorite cell phone carrier was suddenly an option again…

We switched from Straight Talk to Ting, and I’m thrilled to be back.

When we discuss finances — loans, payments, credit cards, investments, and mortgages — there is usually one important item missing from the discussion: risk.

It’s scary how much we ignore it. Perhaps we hope that if we don’t even acknowledge risk, we can’t be harmed by it.

No matter your current situation, you can get a raise. It’s not a trendy new concept. It’s not even hard. It’s a matter of financial discipline.

Be forewarned, though. It requires following two simple (but not necessarily easy) steps.